U.S. Airlines 2024 Year-End Review: Winners, Losers

As 2024 winds down, it’s time to reflect on a year that was anything but predictable for the U.S. airline industry.

From financial highs and operational lows to mergers and bankruptcies, the aviation sector showcased its resilience while grappling with challenges that tested even the most seasoned carriers.

Here’s my take on the year’s standout performers, those who stumbled, and what it all means for 2025.

Who Soared: Delta and United Airlines

When it comes to financial performance, Delta Air Lines and United Airlines were the clear leaders in 2024.

For the twelve months ending September 30, 2024, Delta reported a revenue of $60.306 billion, marking a 5.32% increase year-over-year. Delta's operating income for the same period was $5.601 billion, a slight decline of 1.16% compared to the previous year.

United Airlines reported a revenue of $55.99 billion for the twelve months ending September 30, 2024, reflecting a 4.24% increase over the previous year. The airline's net income for this period was $2.764 billion, a decrease of 3.39% year-over-year.

For Delta, the airline’s focus on premium offerings, like new Delta One lounges in major cities, helped it capture high-margin business travelers—a segment that rebounded strongly this year.

United Airlines took a different approach to growth, aggressive international expansion. In October, it announced eight new destinations, its largest international expansion in history.

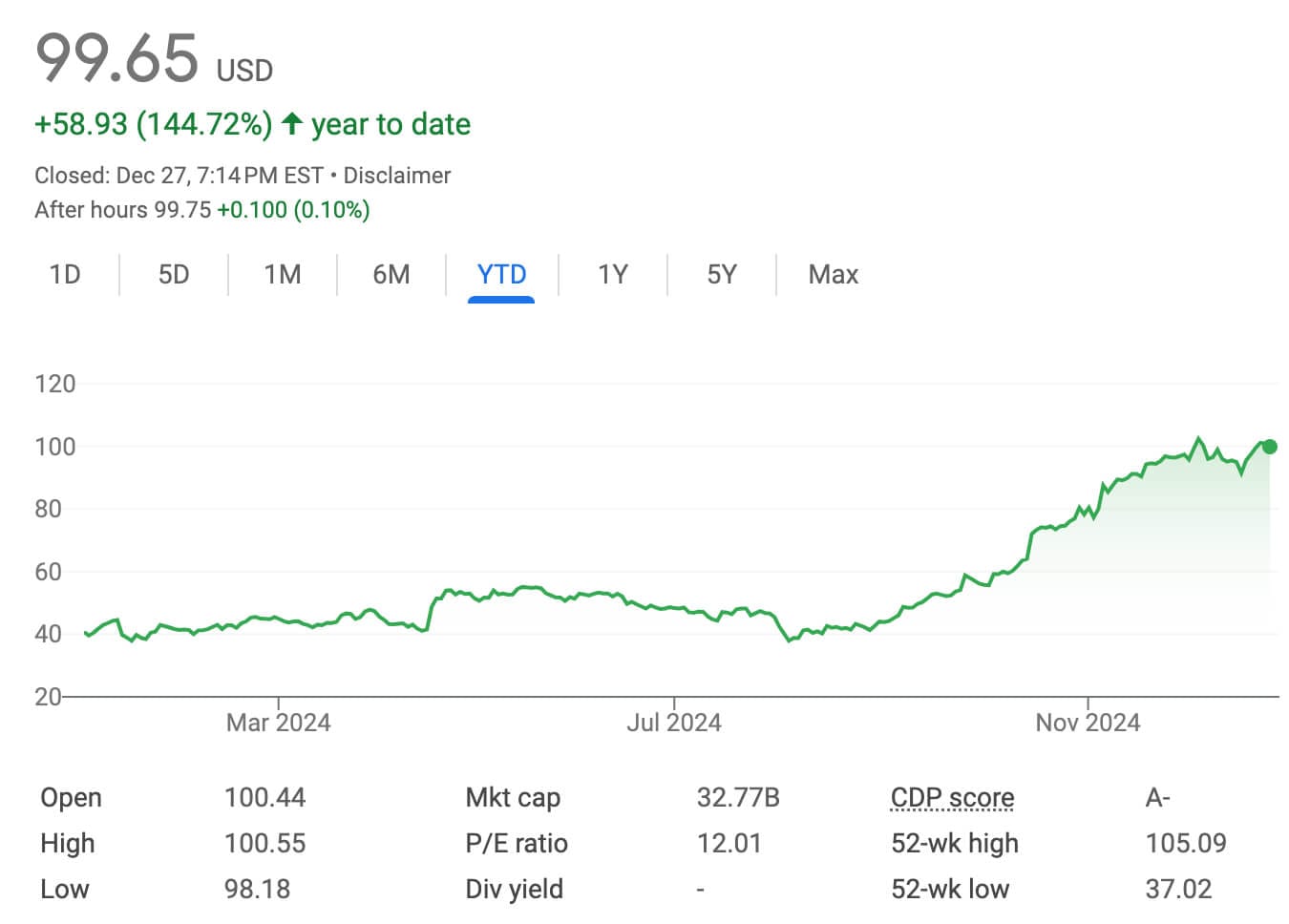

Its strategy of targeting premium leisure travelers paid off handsomely, as did its investment in fleet upgrades featuring seat-back screens and free Starlink-powered WiFi. Investors rewarded United’s bold moves; its stock grew by more than 144% this year, making it the top-performing U.S. airline stock of 2024.

Who Struggled: American Airlines and Spirit

American Airlines had a rough year, marked by a failed direct-booking strategy that alienated travel agencies and led to a $149 million loss in Q3 alone. The fallout from this misstep forced a leadership shakeup and a return to traditional distribution channels.

While American Airlines is optimistic about year-end demand, it trails competitors like Delta and United in profitability and operational efficiency.