Delta Air Lines Outlook 2025

I find 2025 uniquely interesting for Delta Airlines because it marks a phase when many tactical strategies are finally bearing fruit.

At this point, Delta is looking to have a promising year, buoyed by consistent premium travel demand, robust cash flow projections, and optimism on numerous fronts. From what I’ve analyzed, 2025 might be one of the airline’s best years yet, assuming they keep their momentum going.

In this analysis, I’m going to share my perspective on Delta’s 2024 performance and break down how that sets the stage for 2025. I’ll also explore their growth drivers, route expansions, partnerships, and how all of this plays into my overall outlook for Delta in the year ahead.

At the end of the day, I want to provide more than just an overview.

I plan to dig into how each piece of the puzzle—operational refinements, fleet strategy, corporate travel, and premium offerings—comes together to shape the airline’s trajectory.

Let’s get started.

Analyzing Delta’s 2024 Performance and Setting the Stage for 2025

I see last year (2024) as a kind of warm-up lap for Delta. When I look back at the final quarter of last year, I notice that their operating revenues reached nearly $15.6 billion, up from about $14.2 billion the year before, exceeding many initial forecasts.

On the earnings side, Delta finished 2024 with a solid pre-tax income of around $5 billion. It also managed to generate about $3.4 billion in free cash flow, which was a sign that they were steadily recovering from the turbulence induced by the pandemic period.

Those numbers alone are impressive, but I find it more interesting how Delta positioned itself for 2025 by focusing on premium cabins, loyalty programs, and other higher-margin segments.

The airline's partnership with American Express, for example, brought in around $2 billion during Q4 of 2024, up roughly 14% year over year. That jump suggests to me that Delta's strategy of differentiating its premium offerings, plus deepening collaborations with financial institutions, has borne fruit.

Simply put, more and more passengers are gravitating toward experiences that offer them extra comfort and loyalty benefits, and Delta is tapping right into that trend.

In my view, that position sets the airline up for this year's endeavors.

If an airline can thrive during a recovery phase—by sustaining passenger loyalty, attracting corporate flyers, and fine-tuning its operations—it stands on solid ground entering the next phase of growth.

And that's precisely what we see with Delta as 2025 unfolds.

Financial Gains from Premium and Corporate Travel

I find it impossible to talk about Delta's 2024 performance without zeroing in on the role played by premium travel demand and corporate flyers.

The main cabin remains the backbone of many routes, yet the heart of Delta's revenue growth has arguably been the premium segment.

Near the close of last year, premium cabin ticket revenue rose around 8%, while the main cabin advanced only 2%. That difference may appear modest, but, given the higher yields in premium seats, it significantly boosted Delta's margins.

Corporate travel is another important piece of the puzzle.

A lot of businesses have weighed the cost-benefit of in-person meetings since the pandemic, but it seems that many corporate road warriors are still traveling, especially to major hubs, for conferences and client engagements.

In one of Delta's corporate surveys, roughly 90% of respondents planned to maintain or increase their travel volumes, including business-class bookings, through the early part of 2025.

Although corporate travel hasn't soared back to pre-pandemic numbers across the entire airline sector, Delta's specific brand loyalty and emphasis on reliability appear to be reeling in a fair share of that market.

I've also noticed Delta refining the overall passenger experience to justify premium wedges—things like dedicated check-in areas, improved seats, better in-flight entertainment, and an expanded route network that caters to business travelers.

By combining convenience with a sense of exclusivity, the airline builds a persuasive case for small to midsize companies and large corporations alike. And in an era where some businesses remain price-sensitive, the consistent, dependable product that Delta provides often tips the scales.

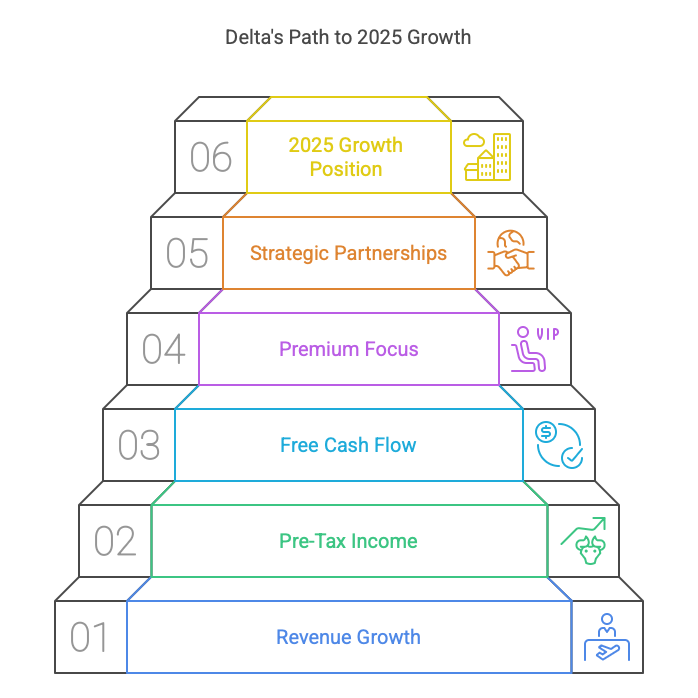

Delta's Key Outlook for 2025: Growth in Revenue, EPS, and Free Cash Flow

As 2025 unfolds, Delta's leadership is projecting first-quarter revenue growth of 7-9% year over year and aiming for earnings per share in the range of $0.70 to $1.

I've spoken to a few peers in the aviation analytics space, and they suspect Delta's surpassing the upper end of that range is entirely possible if leisure demand doesn't taper. In addition, Delta hopes to surpass $4 billion in free cash flow across 2025, representing around an 18% rise relative to 2024.

That's a major accomplishment for any airline, let alone one that's faced the same supply chain constraints and pilot staffing challenges many carriers are dealing with.

The free cash flow projection is particularly interesting to me.

So many airline balance sheets took a beating over the last few years from COVID-related disruptions. In the aftermath, airlines scrambled to reduce debt and reconfigure their fleets for a new era of capacity and demand.

Delta's strong free cash flow might let them pull the trigger on new aircraft purchases or expedite cabin retrofits for older jets.

It's not surprising that they also want to reduce leverage, but I anticipate that some portion of that liquidity will be funneled toward upgrading the passenger experience, especially if they see an opportunity to keep winning on premium seats.

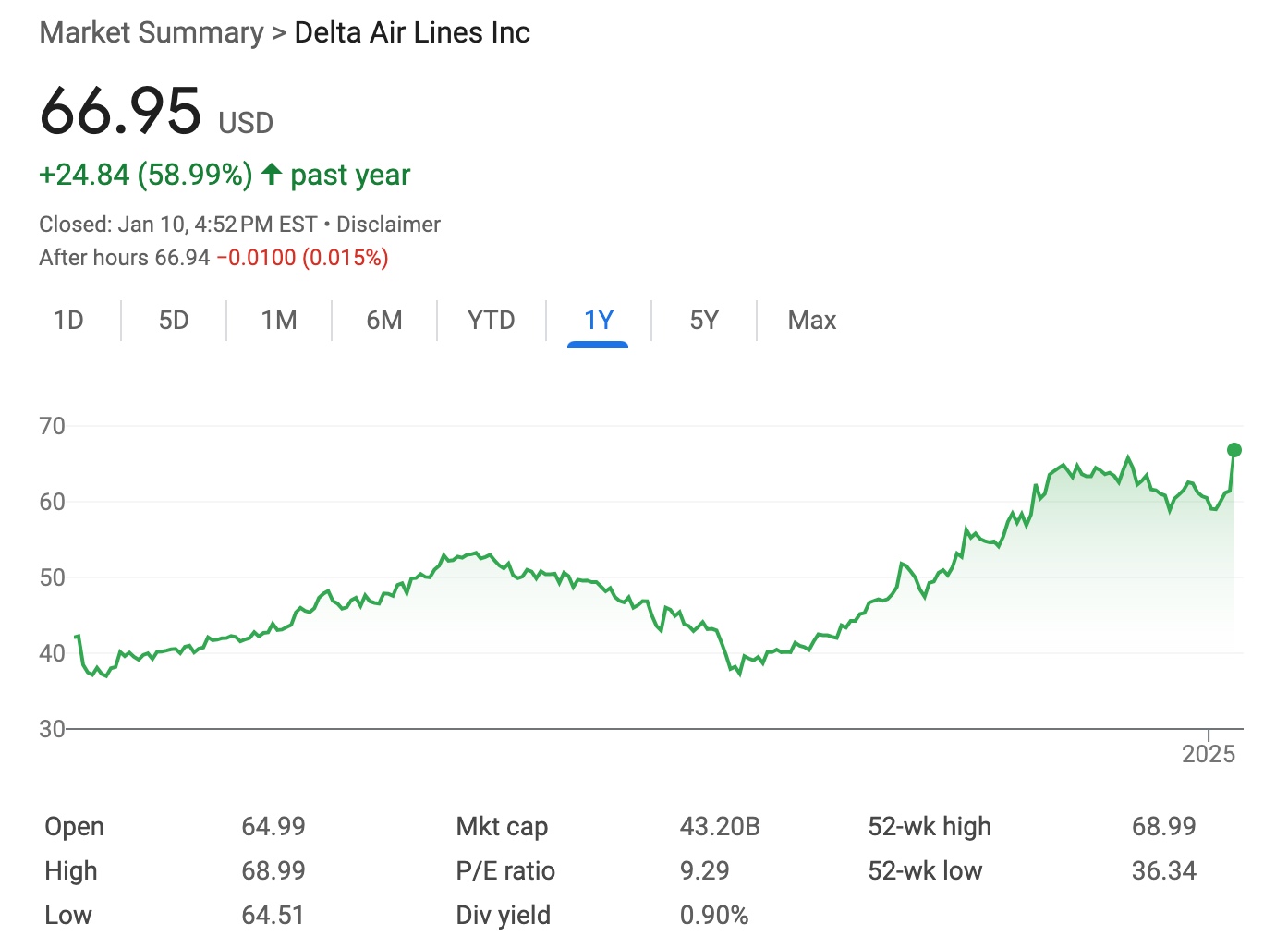

Confidence and Market Reactions

It's not just me who's excited about these projections.

Investors reacted enthusiastically once Delta released its upbeat forecast for Q1 2025, lifting the stock by double digits at one point.

I can't speak for everyone in the investing sphere, but my sense is that many see the airline's pivot toward premium demand, combined with the broader recovery in leisure and corporate travel, as a recipe for outperformance.

Historically, airlines have been notoriously cyclical and subject to unpredictable externalities. But Delta seems to be leveraging the lessons of the last few years to create a more robust, balanced approach to revenue generation.

I do notice, though, that some analysts voice concern about how inflationary pressures, potential slowdowns in consumer spending, and global uncertainties could still throw a wrench into demand forecasts.

Those concerns are valid, and I feel Delta's not immune to such macro shocks.

But the airline's management, led by CEO Ed Bastian, has repeatedly spoken about how they see travelers continuing to prioritize experiences—like a comfortable flight—over certain goods.

That perspective firms up Delta's belief that an experience-driven economy can remain resilient if broader macro conditions remain at least moderately stable.

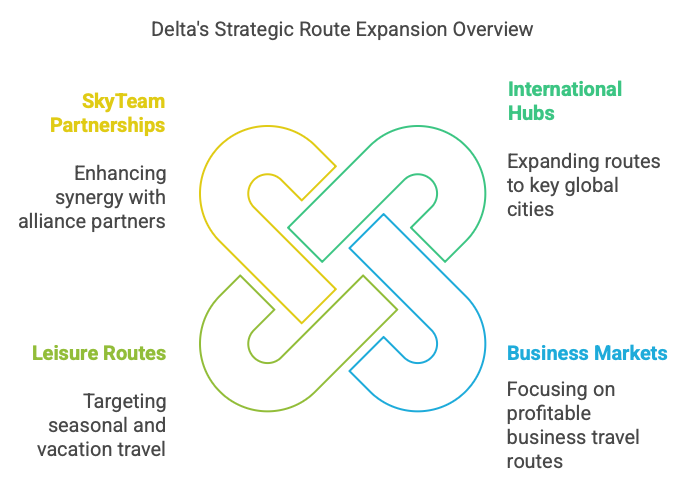

Strategic Route Expansion and Global Connectivity

I'd be remiss if I didn't talk about routes.

Over the past year, Delta's route expansions have been methodical, with a keen eye on profitable markets rather than just raw seat growth. Entering 2025, the airline released announcements highlighting new launches to key international hubs in Europe and Asia, along with expansions to certain Latin destinations.

From what I see, Delta is forging ahead with a well-curated mix of leisure and business routes.

For instance, the resumption of nonstop service between Los Angeles and Shanghai is expected sometime this summer, pending final approvals. That route plays directly into the airline's strategy of tying together major U.S. gateways with significant business markets in Asia.

Meanwhile, on the European side, new routes out of Minneapolis-Saint Paul (MSP) to Copenhagen (CPH) bolster connectivity to places like Denmark, which in turn fosters synergy with SkyTeam partners that have a presence in that region.

I also note that Delta has been reinvigorating certain seasonal routes in Latin America, targeting people who want winter getaways or summer breaks. I see these expansions as an acknowledgment that leisure travelers remain a vital contributor, especially when the corporate side of the house sees seasonal lulls.

And if the airline can line up the schedule so that it attracts families and vacationers, it can fill seats in the off-season.

Domestic Network Refinements

While the glitz and glamor often go to the international side, I find it equally important that Delta keeps refining its domestic network.

Hartsfield-Jackson Atlanta International Airport remains Delta's largest hub. The scale at ATL is massive, so I'm always interested to see how Delta invests in welcoming more flights and upgrading connecting facilities.

There's talk of 968 daily flights from ATL in peak summer 2025, along with expansion in some domestic leisure routes that remain high-demand. In my mind, that diversity of flights cements Atlanta's status not just as a Southeastern powerhouse, but one of the major global crossroads.

Similarly, I see opportunities for Delta to tweak schedules in places like Seattle, Detroit, and Minneapolis.

For me, the question is: how does Delta maintain strong unit revenue across domestic flights when competition remains robust from carriers like Southwest, American, and United?

The answer seems to hinge on fortifying hub schedules, maintaining operational reliability, and offering a premium travel experience that people will pay for, even on a two-hour hop.

International Developments

For transatlantic and Asia-Pacific markets, there's been a seismic shift throughout the entire industry.

Many carriers resumed or grew international flights once restrictions lifted, yet global capacity has remained restricted in certain corridors due to supply chain issues with new aircraft and ongoing geopolitical complexities.

Delta appears to have leveraged this environment by focusing on routes that yield higher returns, capturing that blossoming segment of premium business-class travelers heading to Europe or Asia.

In Europe, I find it notable that Delta is investing in routes that intersect with its expanded code-share or alliance agreements in the region. That synergy reduces overhead costs while broadening the airline's global footprint.

And over in Asia, Delta's reintroduction of flights to Shanghai from Los Angeles is a statement that they believe trans-Pacific travel will keep climbing.

With China's travel sector steadily recovering, even if not fully at 2019 levels, Delta is positioning itself to benefit from revived business and leisure traffic to that region.

My Take on the Competitive Landscape for Delta and Partnerships

I get it: the airline industry is hypercompetitive.

But, I see Delta setting itself apart through a carefully cultivated brand image of reliability, customer-centric service, and an emphasis on more comfortable experiences, which includes signature cabins like Delta One and Premium Select.

Partnerships with carriers such as Air France-KLM, Virgin Atlantic, Aeromexico, Korean Air, and newly realigned codeshares with SAS (especially in the wake of SAS leaving Star Alliance to join SkyTeam) help Delta extend its global presence.

Once the entire alliance synergy is accounted for, customers can expect a fairly seamless global network—something that's not always easy to replicate.

I think partnerships extend beyond just other airlines. There's also the synergy with Airbus on next-generation fleet innovations.

For me, that's an interesting thread to follow, because it shows an airline that's looking to get more fuel-efficient aircraft, incorporate new cabin technologies, and possibly accelerate decarbonization efforts in line with industry-wide goals.

If you can align with your aircraft manufacturer on next-level R&D, you get first dibs on interesting product rollouts that might enhance passenger comfort and operational efficiency down the line.

Industry-Wide Recovery Trends

Knowing that 5.2 billion global passengers may take to the skies in 2025, as forecasted by the International Air Transport Association, I see a surge that could produce a record revenue environment for the larger airline ecosystem.

Delta is riding the wave of that expansion. During the darkest days of 2020, I wondered how long it might take for passenger volumes to bounce back.

Now, we're witnessing a scenario where worldwide travel has expanded again, though with new patterns, new flows, and revived appreciation for travel experiences.

One point worth mentioning: yield management might shift back to more traditional patterns this year.

During the pandemic recovery, some carriers charged sky-high fares because capacity was limited. Now that capacity is ramping up, I expect yields to moderate a bit.

Then again, Delta's premium cabins can command higher fares, providing a layer of insulation from normal yield drops.

As far as domestic coach seats are concerned, there's a chance that more competitive pricing might come back if leisure carriers continue to add routes in 2025.

But Delta's advantage might well be its proven track record for reliability and brand loyalty, especially if travelers recall the meltdown experiences certain low-cost carriers had in prior years.

Challenges and Potential Risks for Delta

I don't want to sound overly rosy, because I realize an airline's fortunes can shift quickly.

My biggest concern for Delta is the supply chain. Upstream disruptions in aircraft production or parts availability can hamper the airline's efforts to deploy more flights or accelerate the retirement of older aircraft.

I've seen airlines throughout the world complaining about slow deliveries of new jets.

Airbus and Boeing have to juggle enormous backlogs and labor challenges, so it's plausible that Delta might experience delays for some new aircraft or face difficulty maintaining older planes if parts become scarce. That can hamper efforts to meet capacity targets and lead to schedule disruptions.

On the labor front, pilot and crew contracts are a perpetual factor for U.S. carriers.

Delta did finalize new pilot contracts in recent months, but wages and benefits remain a considerable cost driver. If any future negotiations turn contentious, that could affect the airline's cost structure.

Additionally, the airline might face rising fuel costs if the energy markets tighten unexpectedly—though that's always been a wild card in aviation.

Moreover, global uncertainties, including geopolitical tensions in certain regions or economic downturns, could dampen business travel and long-haul leisure trips.

I know some economists are forecasting slower growth for 2025, but consumer spending patterns have remained robust so far, leaning heavily into travel. If that spending spree cools off, demand could slow.

That said, Delta's leadership has expressed confidence that experience-focused travel is still a top priority for many, offering them a bit of a cushion if the economy flattens out.

Aerospace Supply Chain Bottlenecks

When I examine supply chain bottlenecks more closely, I realize they can ripple through an airline's operation.

If an aircraft manufacturer doesn't deliver planes on schedule, Delta may have to keep older planes flying, funneling more resources into maintenance, which often yields higher operating expenses.

Delays in getting replacement parts or specialized components can also ground certain aircraft, reducing capacity. In that case, Delta might miss out on the revenue opportunity from strong demand surges around holidays or business conventions.

On a broader level, these disruptions can shape how an airline strategizes route deployment and capacity scheduling.

Supply chain woes aren't unique to Delta, though. The entire industry is grappling with them.

But in my mind, how effectively Delta navigates these challenges could either reinforce or harm its brand. If they handle them expertly (by swiftly shifting aircraft where needed and keeping schedule changes minimal), it further cements their image as a reliable carrier in the midst of adversity.

Conversely, if it leads to frequent cancellations or last-minute service changes, that tarnishes the brand.

My Reflections and Conclusion

As I look at the big picture, I see Delta confidently heading into a year that could reshape our understanding of post-pandemic airline economics.

The airline's push toward premium offerings and loyalty-building initiatives was a cornerstone of its robust 2024 finish, and I see that theme carrying right through 2025.

With a projected first-quarter revenue jump of 7-9%, earnings per share expectations that outstrip analyst estimates, and a stated goal of generating more than $4 billion in free cash flow, Delta's leadership has put forth an ambitious roadmap.

If the airline can hit these targets, it might set an internal record for profitability and solidify its ability to outpace rival carriers.

My hope is that Delta continues refining its approach to route planning, pairing domestic expansions with strategic international service to fast-growing markets.

I'm also interested in watching how the airline invests in new technologies, from next-generation aircraft engines to improved cabin experiences. Partnerships with Airbus and other partners could unlock the potential for more fuel-efficient fleets, further boosting the bottom line.

At the same time, as an analyst, I can't ignore the challenges. Supply chain kinks, labor costs, and macroeconomic headwinds are always in the background, threatening to dampen otherwise optimistic forecasts.

Ultimately, as of this moment in early 2025, I'm quite optimistic about Delta's prospects.

From the vantage point of travelers, they get more connectivity with a higher standard of onboard comfort. From the perspective of investors, they see an airline that has navigated the post-crisis period and found ways to shore up its finances, expand key routes, and attract premium-paying customers. From Delta's angle, that combination of factors fosters confidence that "2025 is our best financial year".

So, whether I'm booking a summer flight to Europe or reading an earnings transcript, I'll keep a positive outlook on Delta's journey in the coming months.

I anticipate that the remainder of 2025 might bring more refinement—like just-in-time route adjustments, carefully negotiated partnerships, and expansions of lounge offerings.

If all that is balanced well, Delta can maintain its brand reputation for reliability and consistent service. And that might just be the key that sets it apart from the rest of the pack.

I'm excited to see how it all plays out, and I'll be sure to keep following developments, especially once the airline announces additional quarterly results and forward growth plans.

With any luck, the next twelve months will confirm all the optimism swirling around the airline.

Right now, the runway looks quite clear for Delta to take flight in 2025.